Showing top 0 results 0 results found

Showing top 0 results 0 results found

Have you ever wondered how the financial world manages to keep up with the demands of the digital era? Fintech chatbots are the answer.

These AI-driven finance chatbots are not just a futuristic concept; they are revolutionizing how we interact within the financial services industry.

Fintech businesses have saved $7.3 billion in operational costs by implementing chatbots. Moreover, these smart assistants have also saved around 826 million hours of customer interaction.

Let's dive into the transformative power of fintech chatbots and how they are reshaping the landscape of financial services.

What is a fintech chatbot?

A fintech chatbot, utilizing natural language processing (NLP), is an AI-powered tool that facilitates text or button-based conversations, offering an alternative to direct interaction with human agents in financial institutions.

These chatbots are available 24/7 to offer quick and effective solutions for common financial issues in the banking and financial sectors.

Managing transactions, resetting passwords, or opening a new line of credit is simple with a fintech chatbot, revolutionizing traditional banking.

Unlike traditional customer service in banking and other financial institutions, these chatbots can handle multiple requests simultaneously, making them an invaluable asset to any economic operation.

Why are fintech chatbots important?

The financial services industry is rapidly changing due to increased demands from tech-savvy customers. This shift is evident in the numbers: fintech service usage in the U.S. soared from 37% in 2020 to 65% in 2022.

AI chatbots are driving transformation in the financial industry. Their interactions have surged by 3150% from 2019 to 2023, signaling a significant shift in business communication.

These financial bots aren't just about keeping pace; they're redefining customer engagement, potentially saving businesses an estimated 862 million hours.

This fintech revolution prioritizes efficiency, accuracy, and personalization in business-customer interactions. Personalization involves tailoring information, products, or experiences to an individual's needs and characteristics to create a more personalized experience. If you’re interested in making personalization your top priority, check out the ChatBot Academy Lesson.

What are the benefits of fintech chatbots?

Fintech chatbots are reshaping the financial landscape by streamlining tasks and driving business growth. Let's delve into some of the key benefits they offer:

Enhanced data analysis and reporting

Fintech chatbots, like ChatBot, are adept at turning raw data into actionable insights. For instance, they can analyze users' spending habits to provide personalized budgeting advice. In a business context, they can swiftly compile financial statements, such as generating a profit and loss report for a small business owner, saving them hours of manual work.

Improved security and fraud prevention

Fintech chatbots vigilantly monitor transactions, taking care of the first line of security. For example, imagine a chatbot detecting an unusual transaction pattern in a user's account and immediately flags it, preventing potential fraud. This proactive approach is key to protecting customer assets and maintaining trust.

Operational efficiency and cost reduction

Chatbots streamline operations by handling routine inquiries such as balance checks or transaction history requests, significantly reducing the need for a large customer support team. They also automate compliance tasks, like KYC verifications, making the process faster and more cost-effective.

24/7 customer service and unbiased decisions

By offering constant support, fintech chatbots can assist customers anytime with tasks like resetting passwords or blocking a stolen card. Their use of AI ensures unbiased decision-making, such as evaluating loan applications objectively based on data rather than human actions.

Personalized financial services and advice

Chatbots can analyze a customer's financial history, including credit scores, to offer personalized financial advice or savings plans, much like a personal financial advisor. This customized approach helps users make more informed financial decisions tailored to their unique circumstances.

Enhancing customer satisfaction and transaction security

The combination of customized service and prompt response enhances customer satisfaction. For example, a chatbot can rapidly verify a transaction, providing additional security while guaranteeing a seamless user experience.

Start a free 14-day trial to see what our ChatBot can do.

Examples of fintech chatbots

Fintech chatbots, especially ChatBot, are transforming the financial industry. Let's explore how they're making a difference in various areas.

Digital transactions

Fintech chatbots are transforming digital transactions into a simple, chat-based process. For instance, when buying a coffee, instead of traditional payment methods, a chatbot can facilitate the transaction through a messaging app.

A product like ChatBot can be beneficial in offering a secure and efficient payment process directly from your phone. This makes digital payments as easy as sending a text.

Additionally, ChatBot provides an Ecommerce Template that can promote special offers, process orders, and support your customers.

Account management

Chatbots make account management straightforward and user-friendly. Need to check your balance or recent transactions?

They can provide account updates instantly, acting as a 24/7 personal banker that eliminates the need for traditional banking methods.

Investment advice

In the realm of investments, banking chatbots can offer personalized advice. They analyze your financial history and goals to suggest suitable investment strategies.

For example, ChatBot could function as an on-demand financial advisor in the finance industry, helping users navigate the complex world of investments with personalized financial advice.

Customer support

Finance chatbots are revolutionizing customer support in the financial services industry. They are always available to answer queries about accounts or services, providing instant support.

ChatBot is designed for customer support to streamline every aspect of your customer service processes and help your team and customers achieve their goals faster.

Insights and analytics

Fintech chatbots can analyze spending and saving patterns, offering valuable financial insights. They act like personal financial analysts, helping users understand and improve their financial health.

Insurance and loans

Chatbots can guide users through options and processes when considering insurance or loans.

They can simplify financial products to help users make informed decisions about loans and insurance policies.

Fraud detection and prevention

Fintech chatbots play a crucial role in monitoring transactions for suspicious activities, thereby enhancing security. They act as vigilant guardians of your finances, similar to how ChatBot could alert users to unusual account activities, helping to prevent potential fraud.

Finance advice and portfolio management

Chatbots also assist in managing portfolios and providing finance advice. They can offer customized recommendations based on individual financial goals and situations.

In this capacity, a tool like ChatBot could serve as a personal financial planner, aiding users in achieving their financial objectives.

What makes today's fintech chatbots different?

Today's fintech chatbots have evolved into sophisticated conversational apps, redefining customer interactions in finance.

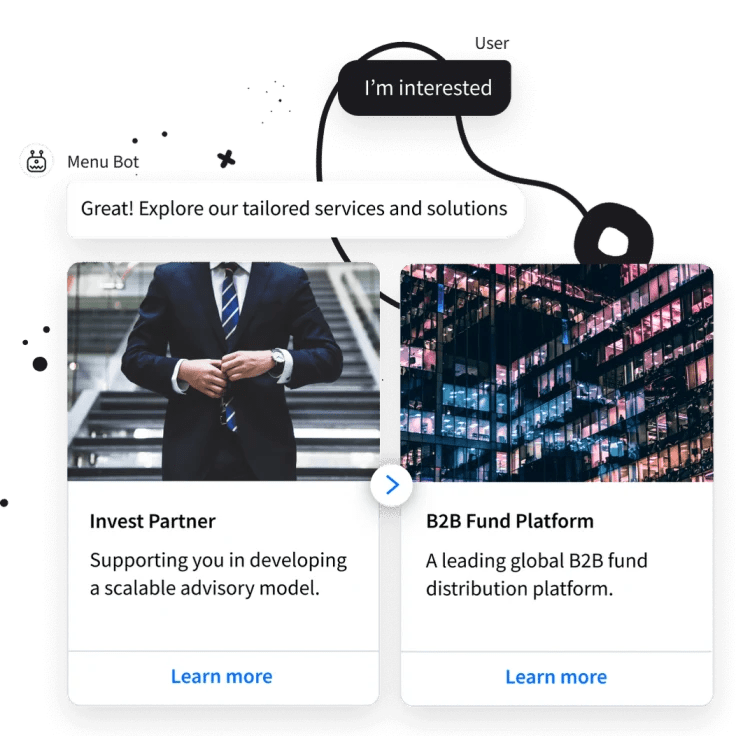

Visually engaging user experience

Days of only text-based chatbots are gone. Modern fintech chatbots, or conversational apps, blend graphic elements with text messaging to create rich, interactive experiences.

They incorporate features like buttons, images, and embedded calendars, making the user interface more intuitive and visually appealing. For example, these conversational apps have reduced customers' time to achieve their goals by 40% and increased goal completion by 25%.

Simplifying complex topics and workflows

Nowadays, fintech chatbots are not just about cost-saving; they're focused on elevating customer satisfaction and loyalty. Successful fintech companies strategically integrate chatbots into the customer journey, using them to automate processes where they enhance customer experience.

These chatbots are capable of handling complex tasks that were previously deemed too intricate for automation. They simplify customer support by eliminating paperwork, reducing wait times, and minimizing frustrating experiences.

This well-planned customer journey ensures that chatbots offer a superior experience to human support teams, marking a significant upgrade from their predecessors.

Start a free 14-day trial to see what our ChatBot can do.

Collaboration with human agents

Contrary to the misconception that fintech chatbots aim to replace human agents, they are designed to work with them. Effective fintech chatbots seamlessly hand over conversations to human agents when necessary, ensuring customer satisfaction is always prioritized.

The Text ecosystem demonstrates a successful integration between a bot and a human. By combining LiveChat and ChatBot, it is possible to leverage the expertise of human agents and advanced AI narratives to provide exceptional customer service. This integration ensures that your chatbot delivers a dynamic and personalized experience to customers, resulting in high customer satisfaction.

This balanced approach between chatbots and human interaction distinguishes it from earlier versions, highlighting the shift towards a more integrated and customer-focused experience.

Read more: 9 Interesting Chatbot Ideas for Businesses in 2024

Automate your financial services with ChatBot

We're seeing fintech chatbots making financial dealings smoother, safer, and more tailored to what customers want. Your business needs to choose the right tool.

Embrace the future of financial services with ChatBot, your go-to solution for automating customer interactions. ChatBot stands out with its ability to provide quick and accurate AI-generated responses to customer inquiries.

Clients in the banking industry and other financial sectors can benefit from ChatBot, as it provides instant access to information, making financial operations more efficient and enhancing customer experience. It can answer FAQs, guide users through complex financial processes, and provide timely advice with precision and speed.

Setting up ChatBot is easy, as it requires no coding. You don't need to be a tech expert to get it up and running; this ease of setup ensures that your financial services are accessible 24/7. ChatBot allows you to offer your customers faster support without any delays, ensuring they have access to assistance whenever they need it.

Using ChatBot, you are upgrading your customer service and fortifying your data security and operational independence. Try it out, thanks to a free 14-day trial.